Table of Contents

- What is Stamp Duty?

- What is Metro Cess Charges?

- How is Stamp Duty calculated?

- What are the ways to pay stamp duty?

- How to Pay Stamp Duty Online in India?

- Current Stamp Duty and Registration Charges in Mumbai

- Registration Charges in Mumbai

- What is the process for Registration

- What is the Maharashtra Mudrank Shulkh Abhay Yojana?

- How does the Abhay Yojana scheme help property owners?

- Phases of the Abhay Yojana Scheme

- How to Access the Abhay Yojana Scheme?

- So how much does a home buyer have to pay in total in Mumbai?

- Few Tips to save on stamp duty and registration charges:

- Faq's

Buying a house demands a lot of thorough deliberation and sorting out finances and paperwork. Amidst sorting through all of these steps, many homebuyers fail to take cognizance of stamp duty and registration charges, which in the long run tends to derail the financial course of a homebuyer.

When buying a property, you are required to pay these taxes. A stamp duty is a tax that is paid to the State government when a property is transferred from one owner to another. It differs from state to state and is determined by the market value of the property you purchase. Your documents are stamped and legally valid only after paying stamp duty. In contrast, a registration charge is a fixed percentage that you must pay to register your property.

Recently, the Maharashtra government announced the Abhay Yojana (amnesty scheme) for the penalty that can be levied for insufficient or non-payment of stamp duty. Read on to know the latest stamp duty and registration charges in Mumbai for male and female homebuyers and the available amnesty scheme.

In this article, we will look at the latest government rules regarding Stamp duty, the stamp duty and registration charges for 2024 in Mumbai along with the metro cess and ways you can pay your stamp duty in Mumbai. We will also talk about the recently announced Abhay Yojana (amnesty scheme) of 2023-24 that attempts to rectify the legal standing of property documents that lack proper stamping.

What is Stamp Duty?

Stamp duty is a kind of property tax that needs to be paid when the property changes hands. The tax was levied when the Indian Stamp Act of 1899 came into place. When a person buys a property in India, he/she has to pay stamp duty based on the value and nature of the property. It is important to remember that stamp duty varies from state to state and on the kind of property i.e. residential or commercial.

The tax includes transactions such as conveyance deeds, sale deeds, and power of attorney papers. The owner only gets complete ownership of the property after the stamp duty is paid.

What is Metro Cess Charges?

On April 2022, The government of Maharashtra levied an extra 1% charge as the Metro Cess Charge when purchasing property in Mumbai, Pune, Thane, and Nagpur, to fund the growth of transport and infrastructure projects. With the levy of metro cess the stamp duty in Mumbai has gone up by 1% to a total of 6% (5% stamp duty + 1% metro cess) while in the cities of Pune and Nagpur, the total has gone up to 7% from 6%.

How is Stamp Duty calculated?

Stamp duty is calculated based on the value of the property and its calculation changes from state to state in India. It is usually derived on the basis of the circle rate set by the state government which is subjected to revision every year.

Circle rate is the minimum price at which any real estate property has to be registered when being transferred. A circle rate is also known as the ready reckoner rate. This rate helps in gauging the property prices of a particular area.

What are the ways to pay stamp duty?

There are three ways via which one can pay stamp duty - franking, non-judicial stamp paper, and e-stamping.

Franking: In this procedure, the details of the agreement are printed on blank paper and are submitted along with the stamp duty amount to a bank that is authorized to carry out a franking transaction. Authorized banks usually charge a fee for this service.

Non-judicial stamp paper: This method requires all the details related to the agreement to be printed on the non-judicial stamp physical paper purchased from a licensed vendor. The stamp papers are then duly signed by the executants. This is the most common payment method for stamp duty.

E-stamping: As the name suggests, it is a digital payment method that makes it tamper-proof.

How to Pay Stamp Duty Online in India?

Numerous state governments have introduced an electronic payment system for stamp duty to streamline the property registration process. The implementation of e-payment for stamp duty allows homebuyers to conveniently pay stamp duty, registration fees, and other charges online with just a few clicks.

This e-stamp registration facility not only simplifies the payment procedure but also enhances efficiency, transparency, and overall simplicity. Homebuyers can easily complete the stamp duty payment for their property acquisition through a straightforward online process, making the entire transaction more user-friendly.

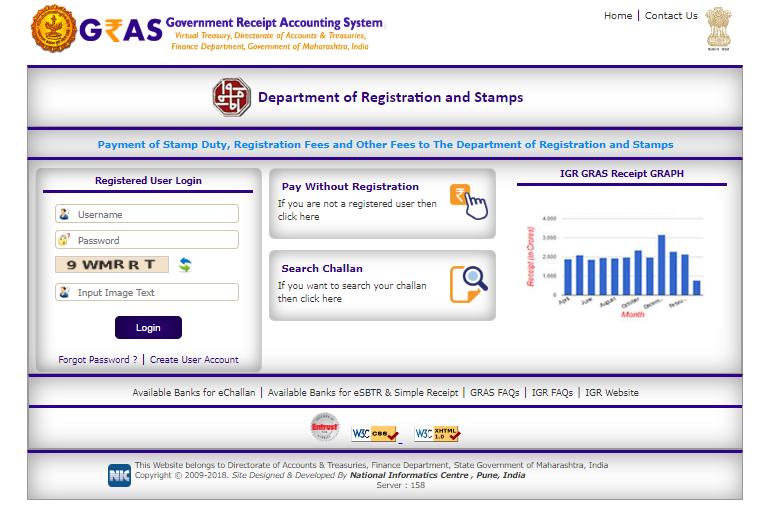

Step 1:Visit gras.mahakosh.gov.in

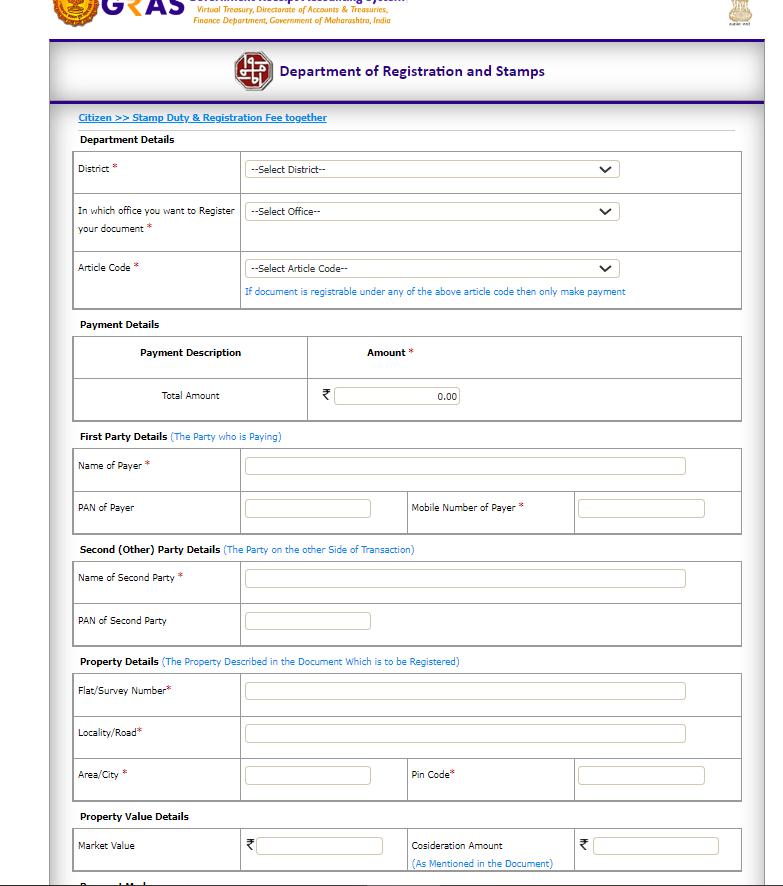

Step 2: After landing on this page, you need to fill up some details regarding the property and its area

Step 3: After all the information is submitted, you need to choose the payment gateway. One can use any of the links of major nationalised banks to complete the payment.

Step 4: After you have selected your preferred bank, complete the payment process.

Current Stamp Duty and Registration Charges in Mumbai

| Areas in Mumbai | Stamp Duty Rates in Mumbai for Men | Stamp Duty Rates in Mumbai for Women |

| Urban areas within municipal limits | 6% of the market value of the property | 5% of the market value of the property |

| within the limits of any municipal council/ panchayat/ cantonment of any area within MMRDA | 4% of the market value of the property | 3% of the market value of the property |

| Within the limits of any gram panchayat area | 3% of the market value of the property | 2% of the market value of the property |

Registration Charges in Mumbai

After the stamp duty is paid, the owner has to get the registration of the property done in their name. This is a charge that the owner has to pay above the stamp duty to get the property registered in their name.

For both men and women, they have to pay Rs 30,000 if the value of the property is above Rs 30 lakh, and if under 30 lakh then 1%.

What is the process for Registration

Documents required for Registration process

- Identification documents such as PanCard, Passport, Driving License of both the buyer and the seller

- Original deed documents along with two photocopies submitted to the Sub-Registrar of Assurances

- Proof of payment of stamp duty

- Payment details of the transaction

- Khata certificate and receipt of taxes paid

One has to submit a sleuth of documents to commence the registration process. Once the documents are scrutinized, the owner is given a receipt and a unique serial number which denotes the completion of the registration process.

What is the Maharashtra Mudrank Shulkh Abhay Yojana?

The Maharashtra Mudrank Shulkh Abhay Yojana, introduced by the Maharashtra government, comes as a significant relief for property owners burdened with stamp duty fees and penalties on documents registered or unregistered between January 1, 1980, and December 31, 2020. This inclusive initiative also covers properties under like Mhada, Cidco, and SRA.

The primary motivation behind this stamp duty amnesty scheme is to rectify the legal standing of property documents that lack proper stamping. According to the Maharashtra Stamp Act, 1958, unstamped sale deeds and conveyance deeds are not considered legally valid. To regularize these documents, property owners are typically required to pay the deficit stamp duty along with a penalty of 2 percent per month, potentially accumulating to over 400 percent of the original stamp duty, a substantial burden for many property owners. Additionally, non-payment of stamp duties hampers housing societies in pursuing deemed conveyance.

How does the Abhay Yojana scheme help property owners?

As per IGR Maharashtra, The amnesty scheme aims to alleviate the burden of paying hefty accrued stamp duty by providing relief on both the stamp duty and the associated penalties, thereby facilitating the regularisation of property ownership. The eligibility criteria encompass documents registered with the sub-registrar of assurances lacking proper stamping, as well as unregistered documents with unpaid stamp duty. Notably, the documents must be executed on authorised stamp papers or through franking centers, excluding those executed on fraudulent stamp papers or acquired from unauthorized vendors like Telgi.

Phases of the Abhay Yojana Scheme

The implementation of the scheme unfolds in phases, with the first phase running from December 1, 2023, to January 31, 2024, and an extension granted until February 29, 2024. Subsequently, the second phase spans from February 1, 2024, to March 31, 2024.

Under the directive issued by IGR Maharashtra, properties in the first phase with stamp duty and penalty amounts up to Rs 1 lakh receive a complete waiver, while those exceeding Rs 1 lakh get a 50 percent waiver on stamp duty and a full waiver on penalties. In the second phase, properties with amounts up to Rs 1 lakh enjoy an 80 percent waiver on both stamp duty and penalties, and those exceeding Rs 1 lakh receive a 40 percent waiver on stamp duty and a 70 percent waiver on penalties.

For properties registered between January 1, 2000, and December 31, 2020, a 25 percent waiver in stamp duty fees is offered for amounts up to Rs 25 crore, with a 20 percent waiver for amounts exceeding Rs 25 crore. Penalties below Rs 25 lakh receive a 90 percent rebate, while those above Rs 25 lakh incur a penalty of Rs 25 lakh.

In the second phase, a 25 percent waiver in stamp duty fees is provided for amounts up to Rs 25 crore, with a 20 percent waiver for amounts exceeding Rs 25 crore. Penalties below Rs 50 lakh are subject to an 80 percent rebate, and penalties above Rs 50 lakh incur a fixed penalty of Rs 50 lakh. This comprehensive scheme aims to bring respite to property owners and streamline the regularization process for property documents.

How to Access the Abhay Yojana Scheme?

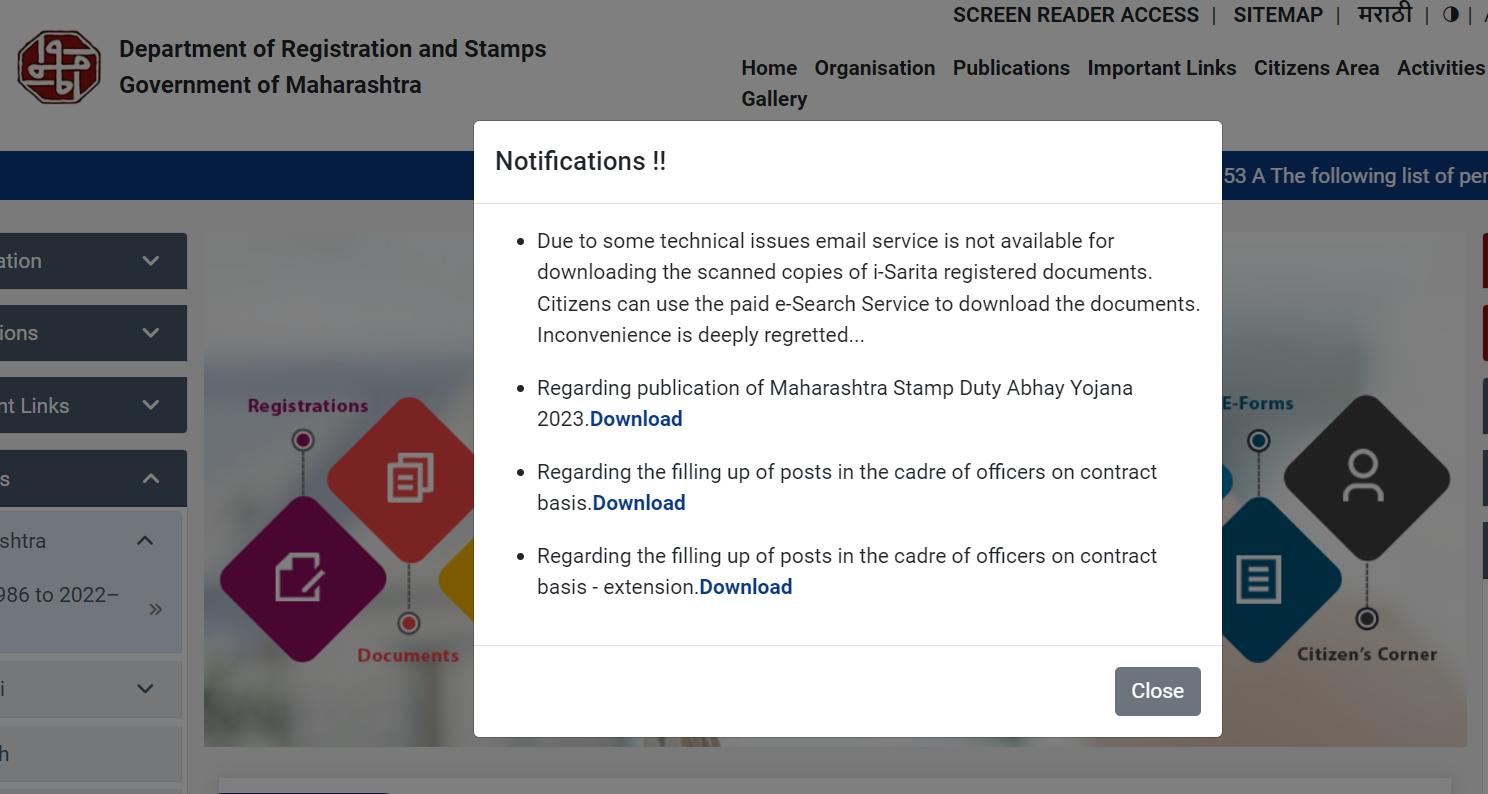

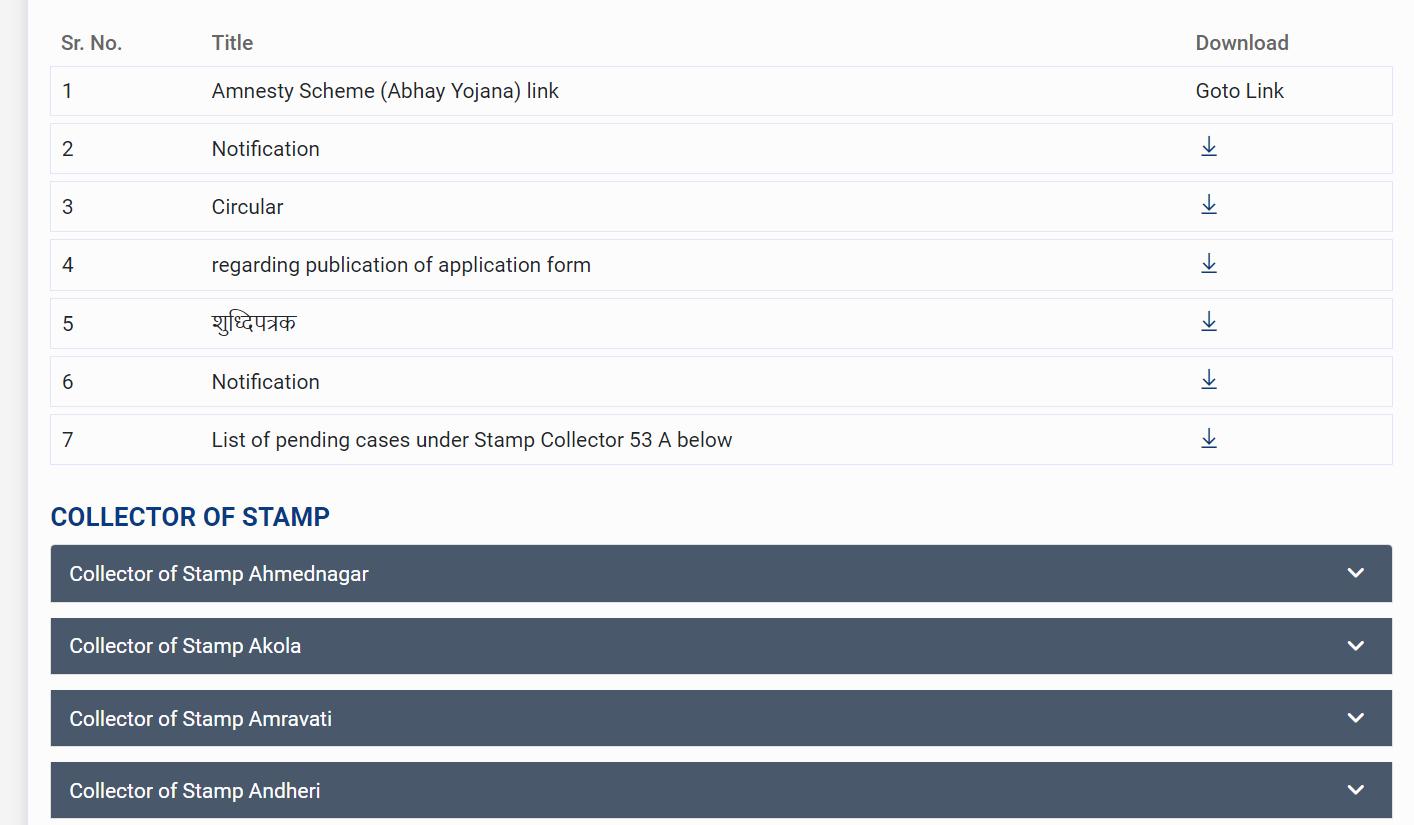

Step 1: Visit IGR Maharashtra website. A pop-up will come with details regarding Abhay Yojana.

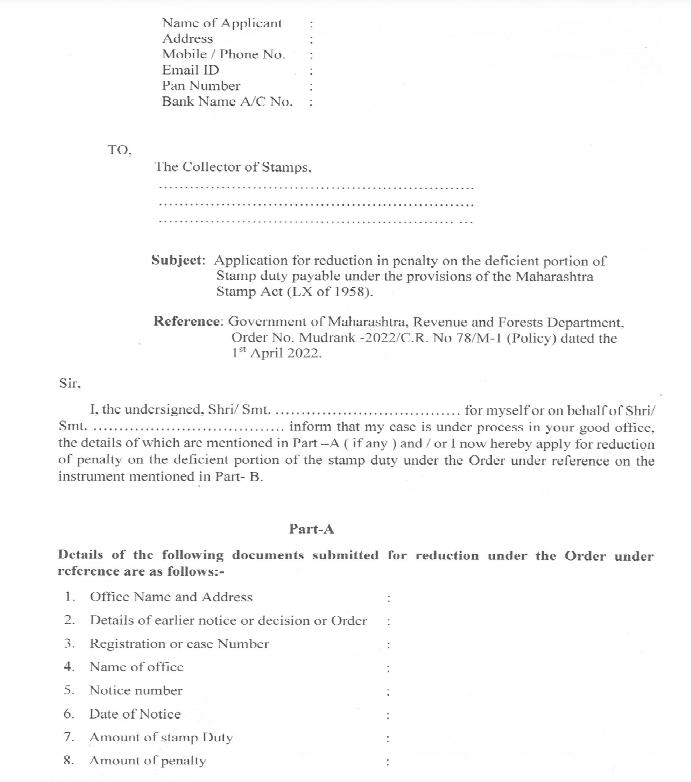

Step 2: Inside the publication, You can access the form that has to be filled and submitted to take advantage of the amnesty scheme. The Form is available both in English and Marathi.

Below is the first page of the form to help you get started

If you want to regularise your property documents then follow the below-mentioned steps

Step 1: Visit IGR Maharashtra website and on the right side (highlighted in yellow in the image)

Step 2: Then proceed to

Click on your desired city and you can download all the details that you will need to regularise your property.

So how much does a home buyer have to pay in total in Mumbai?

If a male homebuyer wants to buy a residential property in Maharashtra along with the property cost, he will have to pay

GST+ Stamp Duty+ Metro Cess + Registration fee + any additional taxes

Few Tips to save on stamp duty and registration charges:

We know that buying a house puts a huge dent on financials, therefore here are a few tips which will allow you save a few bucks on stamp duty and registration charges.

- Some states offer rebates if the property is registered in the name of a female family member.

- One can also claim the amount paid on stamp duty and registration as a deduction under section 80C of the Income Tax Act 1961. According to section 80C, the maximum deduction of stamp duty and registration charges could not exceed 1.5 lakh.